Museveni Blames Sacked URA Officials for Low Revenue Collections

President Yoweri Kaguta Museveni has lashed out at the fired Uganda Revenue Authority (URA) top officials who he accused of running down the institution by engaging in corruption.

The President made the remarks while addressing the nation during the 2020/2021 national budget Speech, when he warned other corrupt public servants that he is coming to clean up their entities.

It should be remembered that President Museveni fired the former URA Commissioner General, Doris Akol in late March and replaced her with John Musinguzi.

The tides shifted to the other top managers including, Dicksons Kateshumbwa (Commissioner Domestic Taxes), Henry Saka (Commissioner tax investigations), Sirajji Kanyesigye Baguma (Assistant Commissioner large taxpayers office) and Samuel Kahima (tax Auditor domestic tax department) in a massive resignation on 29th May 2020.

The URA Board of Directors has since issued a statement indicating that the resignation wasnt forced, but the President has spoken out about the massive resignation indicating the officials were pushed out of the Tax body.

Uganda has got the lowest tax to GDP ratio, it is only 14.3 percent of GDP as tax, African countries go up to 18 and some up to 20, so what is the problem! European countries go up to 40 percent. There has been a lot of corruption in URA, that one I have cleaned as we shall clean some of the other places, wherever there is corruption, we shall get there and clean it up, Museveni said.

According to the Ministry of Finance, the next financial year’s revenue target is UGX 21,810 billion, comprised of tax revenue amounting to UGX 20,219 billion and non-tax revenue of UGX 1,591 billion. This target translates into a revenue effort of 14.3 percent of GDP.

To achieve the set target, the Ministry will implement the following new interventions: –

- Further roll out use of digital tax stamps and expandthe range of products covered in order to deter under-declaration of production and importation. Digital stamps also ensure that goods on the market meet the required health and safety standards;

- Widen the scope of the income tax withholding agents across all sectors in order to broaden the tax base;

- Enhance rental income tax collection and compliance by implementing a digital collection solution, as well as gazette rental income tax chargeable in different geographical areas for taxpayers who do not voluntarily declare their rental income;

- Gazette VAT withholding agents with an applicable VAT rate of 6 percent, and provide for penalties for failure to withhold; and

- Rollout the use of Electronic Fiscal Devices (EFDs), which are – cash registers interconnected to the Uganda Revenue Authority, to improve record keeping and tax compliance.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

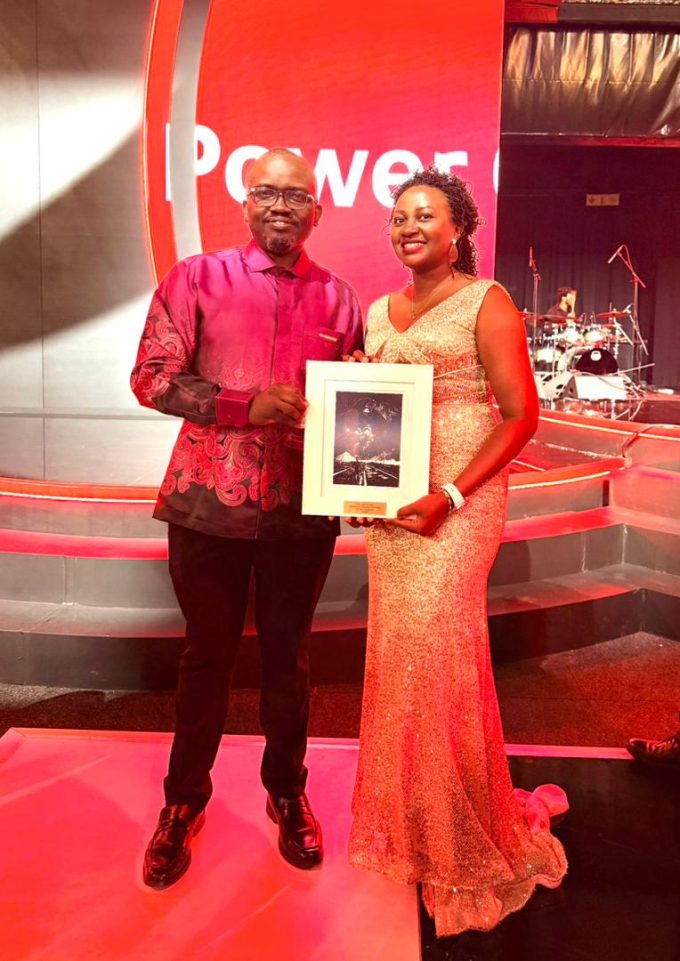

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...