Michael K.Mugabi: Building Institutions, Expanding Access, Shaping Sustainable Impact

Michael Mugabi’s leadership story is one of deliberate institution-building.

He has distinguished himself throughout, that transformative leadership is not built on spectacle, but on clarity of purpose, institutional discipline and an unwavering commitment to national development.

As Managing Director and CEO of Housing Finance Bank, he has steadily transformed the institution into a development-led, inclusive, and increasingly innovative bank anchored in trust and national relevance.

His impact has not been confined to a single year. Rather, it has been cumulative, marked by decisions that strengthen systems, expand access, and align banking with Uganda’s long-term social and economic priorities.

“Strong banks are built on trust, relevance, and a clear development purpose.”

— Michael Mugabi

Governance-Driven Leadership Beyond the Executive Office

Beyond his role at Housing Finance Bank, Michael Mugabi is widely respected for his contribution to corporate governance and financial-sector leadership in Uganda.

He serves as President Emeritus of the Institution of Corporate Governance Uganda and Chair of the Board of Directors of the Uganda Institute of Banking & Financial Services (UIBFS)—roles that reflect his commitment to strengthening leadership standards, professionalism, and institutional resilience across the sector.

These positions reinforce a leadership philosophy grounded in stewardship: building institutions that outlive individuals and deliver value across generations.

Expanding Financial Inclusion Through Physical and Digital Reach

A defining feature of Mugabi’s leadership has been the deliberate expansion of access to banking services. Under his stewardship, Housing Finance Bank has strengthened its physical footprint while accelerating alternative delivery channels.

In recent expansion efforts, the Bank opened three new branches in Masaka, Soroti, and Nansana, extending its presence into high-growth and underserved communities. Complementing this physical growth, Housing Finance Bank has also expanded its agent banking network nationwide by nearly 40%, dramatically improving access to financial services for customers far beyond traditional branch locations.

This dual strategy branches where they matter most, agents where scale is needed has positioned the Bank as one of the most accessible development-focused financial institutions in the country.

“Inclusion is not a concept; it is access—physical, digital, and practical.”

Affordable Housing Innovation: The Zimba Challenge

Innovation has become a core pillar of Housing Finance Bank’s affordable housing agenda under Mugabi’s leadership. Beyond financing, the Bank has actively championed innovation ecosystems that rethink how housing can be delivered sustainably and affordably.

A flagship initiative in this space is the Zimba Challenge, an ongoing national innovation platform that has attracted hundreds of applications from Ugandan innovators, architects, technologists, and entrepreneurs.

Through this initiative, innovators are proposing alternative construction methods, cost-effective materials, climate-smart designs, and scalable housing technologies aimed at closing Uganda’s housing gap.

Rather than positioning the Bank solely as a lender, Mugabi has repositioned it as a convener and enabler of solutions, bridging finance, innovation, and policy conversations around affordable housing.

“Affordable housing will be solved through collaboration, not capital alone.”

Zimba Mpola Mpola and Practical Home Ownership

Complementing innovation is Housing Finance Bank’s practical financing solutions, notably Zimba Mpola Mpola, an incremental housing loan product tailored for low- and middle-income earners. Designed for customers with irregular incomes or limited collateral, the product allows families to build homes progressively—aligning finance with real household realities.

Together, Zimba Mpola Mpola and the Zimba Challenge reflect a holistic approach to housing: financing demand while nurturing innovation on the supply side.

Digital Trust and Institutional Resilience

In a rapidly digitizing financial landscape, Mugabi has emphasized trust as the foundation of innovation. Housing Finance Bank’s achievement of ISO 27001:2022 certification underscored this commitment, affirming the Bank’s robust information security systems and its readiness to scale digital services securely.

Rather than pursuing digital expansion at the expense of governance, Mugabi has ensured that technology adoption is matched with global best practices in risk management and data protection.

Social Responsibility Rooted in Sustainability: The Tiny Forests Challenge

Housing Finance Bank’s approach to social responsibility under Mugabi has increasingly centered on environmental sustainability and long-term community impact. A defining initiative in this space is the Tiny Forests Challenge, which has seen the Bank partner with community institutions, schools, and local stakeholders to establish dense micro-forests in urban and peri-urban areas.

This initiative aligns climate action with education, community ownership, and urban resilience, positioning environmental stewardship as a strategic responsibility rather than a peripheral CSR activity.

“Sustainability is not an add-on. It is a responsibility to the future.”

Why Michael Mugabi Is Making a Mark

Michael Mugabi’s leadership is defined by depth rather than display. Through deliberate expansion, inclusive finance, innovation-led housing solutions, and sustainability-driven social impact, he has helped reposition Housing Finance Bank as a modern, trusted, and nationally relevant institution.

His decisions, grounded in governance, innovation, and access—continue to shape how banking contributes to Uganda’s development agenda.

For these reasons, Michael Mugabi earns his place among Postdator’s 500 Leaders Making a Mark in Leadership and Impact.

Latest News

Botswana Finance Chiefs Turn to Uganda for Lessons on Public Investment Management

Public Investment Management in Uganda is attracting growing regional interest as senior...

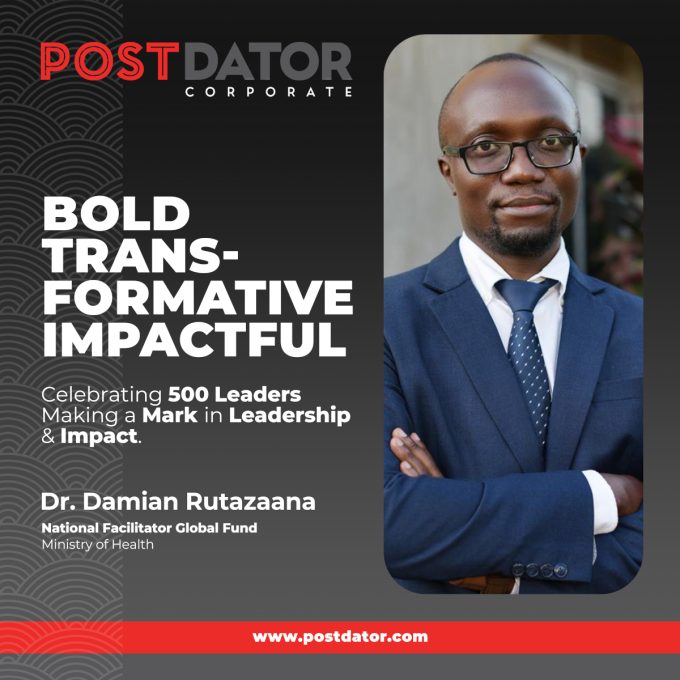

Dr. Damian Rutazaana: Leading Uganda’s National Response to Global Health Challenges

Dr. Damian Rutazaana is a distinguished public health leader and epidemiologist whose...

Absa Bank Uganda Named Best Performing Market Maker in Government Securities

Absa Bank Uganda Named Best Performing Market Maker in Government Securities marks...

Henry Musasizi Outlines Uganda’s Framework for Managing Petroleum Fund and Oil Revenues

Uganda petroleum fund management remains a central priority as the country prepares...