MPs Resist Continuous Recapitalization of Bank of Uganda

Butambala County MP, Muwanga Kivumbi and Dokolo Woman MP, Cecilia Ogwal have come out to rally other legislators to object to the proposal by government to recapitalize Bank of Uganda to a tune of Shs481.7bn.

So as bridge the capital gap, the Central Bank has since requested government through the Ministry of Finance for recapitalization.

It should be recalled that Auditor General, John Muwanga recently revealed that Bank of Uganda is undercapitalized to a tune of Shs671.712b warning that failure by the Central Bank to secure the said funding would pose risks to the operations of the Central Bank.

According to the Bank of Uganda Act, Section 14 (3), the issued and paid up capital of the Bank shall be a minimum of UGX2T but the audit report of 2018/2019 as at June 30, 2019, revealed that the core capital of the Bank was below the minimum required capital by UGX671.712b while in the same period in 2018, the Central Bank was undercapitalized to a tune of UGX482.730b.

Despite the justification for recapitalization, the MPs noted in a minority report of the Budget Committee on the National Budget Framework Paper for the Financial Year 2020/21 to FY 2024/25 that the bank can employ other means than resorting to recapitalization from government.

The legislators noted that the continuous recapitalization of the central bank affects a number of other crucial government programmes like Health, Education and Industrialization.

Government of Uganda is authorized under Section 14 (4) of the Bank of Uganda Act (2000) and Section 36 of the Public Finance Management Act 2015 (as amended); to issue securities for recapitalization of the Bank of Uganda (BoU) where the capital of the Bank is impaired.

The report reveals that as of FY2019/20, Government has recapitalized Bank of Uganda to the tune of Shs l, 160.2 billion.

“If we consider the proposal of Shs 481.7 for recapitalization in the FY2020/21, the total amount for recapitalization of Bank of Uganda will amount to Shs 1, 641.72 billion,” Kivumbi said.

According to the report, the Bank of Uganda informed the Committee of Budget, that as at June 2019, BoU capital was impaired to the tune of Shs 681.712 billion and in October 2019, BoU was partly recapitalized with securities worth Shs 200 billion, leaving a deficit of Shs 481.712 billion which is required in FY2020/21.

“We recommend that, as a means of controlling monetary policy or inflation tendencies, the Bank may consider the following options before requesting for recapitalization: Utilization of savings on Government accounts, Draw down of the General reserve Fund, Deposit auctions and Repurchase agreements,” the MPs suggested.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

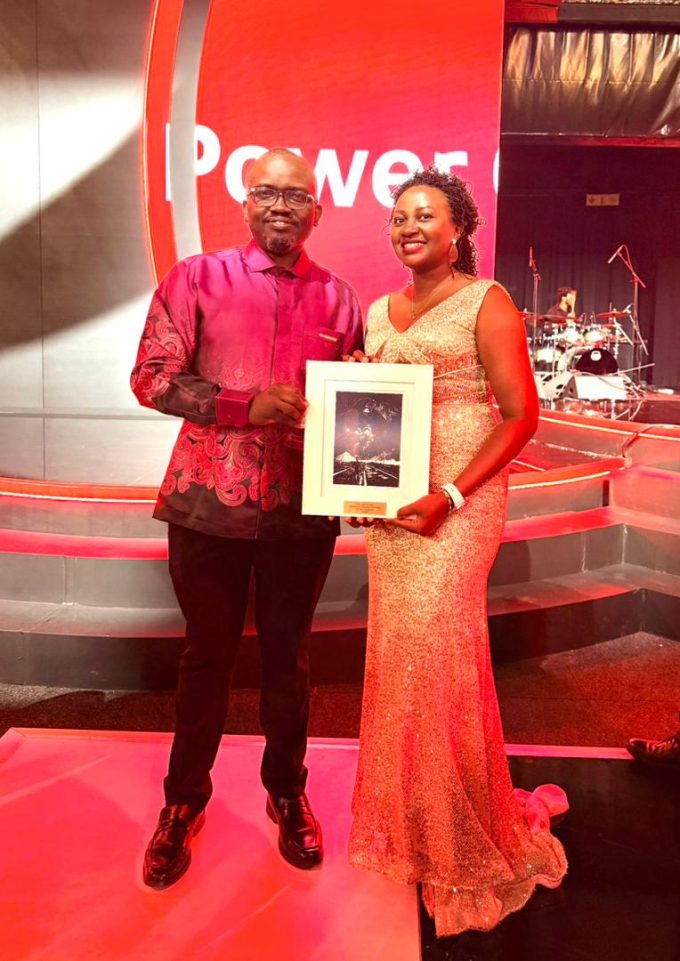

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...