Parliament Clears Budget Framework Paper, Sets Economic Agenda to 2031

Parliament has approved the National Budget Framework Paper (NBFP) for the period FY 2026/27 to FY 2030/31, paving the way for Government’s spending plans and policy priorities ahead of the next financial year.

The approval followed a detailed debate on the report of the Committee on Budget, which reviewed Government’s proposed fiscal strategy and sector priorities.

Speaking during the debate, the Minister of State for General Duties, Henry Musasizi, said the framework anchors Government’s long-term ambition of achieving tenfold economic growth. He explained that Uganda’s strategy is to significantly expand the size of the economy to USD 500 billion by the year 2040.

According to Musasizi, Government’s immediate focus in the next financial year and the medium term will be on scaling up investment in priority sectors under the ATMS and Enablers, while strengthening export-led growth to drive structural transformation. He noted that the economy is expected to register growth of between 6.5 per cent and 7 per cent in FY 2026/27.

The minister also assured Parliament that the Ministry of Finance will work closely with legislators to ensure the national budget is processed within the timelines set out in the Public Finance Management Act. He said the aim is to have the FY 2026/27 budget approved by the end of April 2026, ahead of the swearing-in of the 12th Parliament.

Under the approved framework, Government has committed to tightening fiscal discipline by eliminating practices that encourage misuse of public funds and addressing persistent leakages in recurrent spending, particularly in transfers to frontline service delivery units such as schools and health centres.

Improving cash management, strengthening Uganda’s credit profile, and widening sources of development financing are also key priorities. Government plans to increase the use of innovative financing options while reinforcing internal controls and audit systems to curb corruption.

The framework further outlines reforms in public procurement, better management of public assets, and stronger oversight of state-owned enterprises. Efforts will also be directed towards boosting domestic revenue collection to reduce reliance on borrowing.

To improve project implementation, Government said it will address bottlenecks that slow execution and lead to low absorption of borrowed funds, while ensuring adequate counterpart funding for externally supported projects.

Other planned interventions include strengthening the Uganda Bureau of Standards to improve product certification, enhancing performance management in the public service, and improving coordination across Government institutions.

On domestic arrears, Musasizi said Government will prioritise clearing the existing backlog and prevent the accumulation of new arrears. A phased plan has been put in place to eliminate the current stock of arrears over three financial years starting in FY 2025/26.

Latest News

Bank of Uganda Approves Finance Trust Bank’s Transition to a Credit Institution

The Bank of Uganda (BoU) has formally approved Finance Trust Bank’s application...

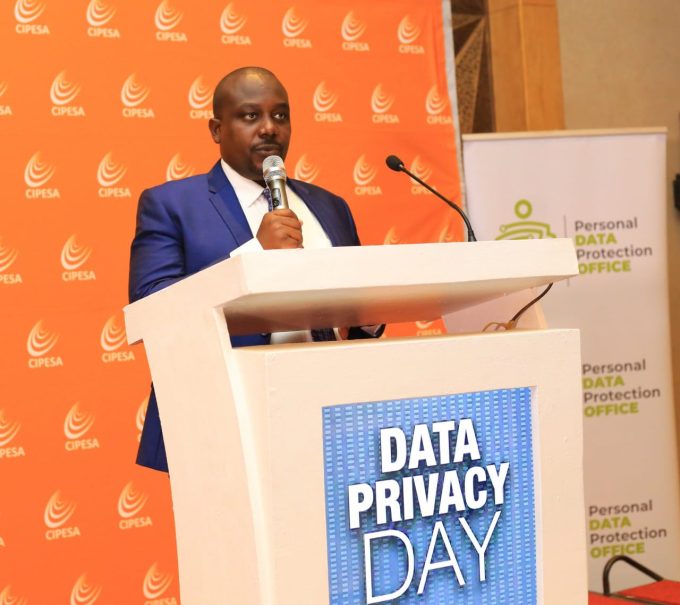

Uganda Marks International Data Privacy Day with DPOs Masterclass

Uganda joined the rest of the world in marking International Data Privacy...

Adris Kamuli: From Humble Beginnings to Industry Trailblazer

Adris Kamuli is one of the most influential figures in Uganda’s creative...

UCC Bans Split‑Screen Advertising on NBS TV, Sets New Industry Standard

The Uganda Communications Commission (UCC) has ordered NBS Television to immediately stop...