First-Ever Credit Data, Referencing & Innovation Symposium Held in Uganda

This week, Uganda hosted its first-ever Credit Data, Referencing & Innovation Symposium 2025, bringing together more than 240 stakeholders from across the country’s financial ecosystem. The event united regulators, government ministries, Credit Reference Bureaus (CRBs), banks, fintech companies, microfinance institutions, SACCOs, and development partners. The symposium was organized by CRBA Uganda Ltd.

The gathering provided a platform for dialogue on the critical role of credit data in supporting responsible lending, promoting financial inclusion, and driving innovation in Uganda’s financial sector.

Mr. Wilbrod Owor, Executive Director of the Uganda Bankers’ Association (UBA), highlighted the importance of collaboration:

“Credit data is the backbone of creditworthiness and trust for responsible lending. By working together, we can unlock innovation and expand access to finance for all Ugandans.”

As a key participant, the Uganda Bankers’ Association reaffirmed its commitment to strengthening Credit Information Sharing (CIS), enhancing financial inclusion, and building trust in Uganda’s credit markets.

The symposium emphasized that robust credit data and collaboration among stakeholders are essential to expand access to finance, improve lending practices, and support economic growth for all Ugandans.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

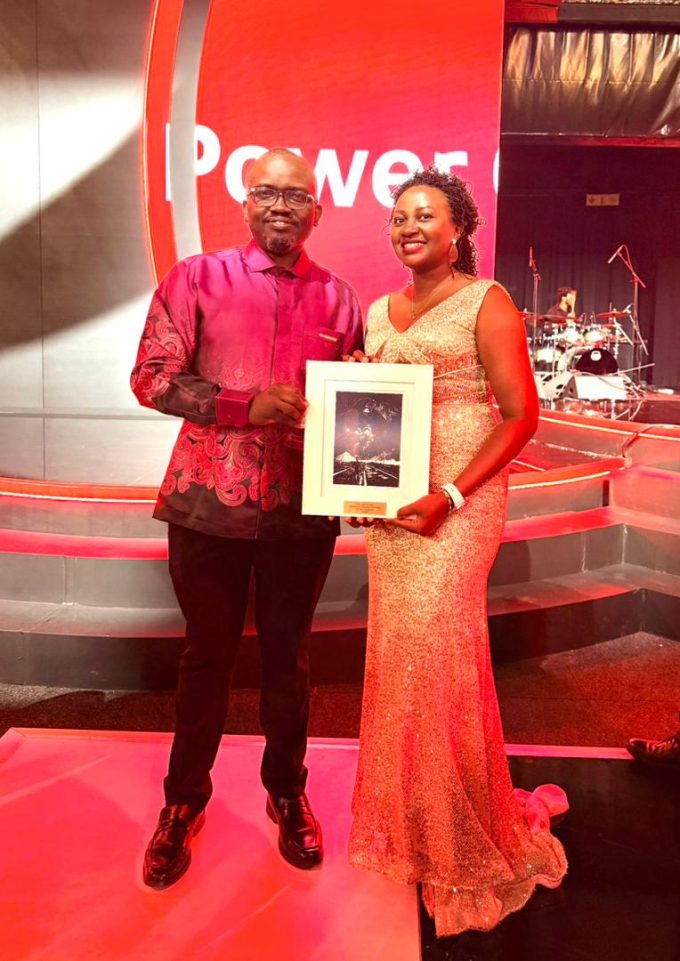

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...