Equity Group Reports 17% Growth in Half-Year Profit After Tax to UGX 968.8 Billion

Equity Group Holdings has posted a 17% rise in profit after tax for the first half of 2025, climbing to UGX 968.8 billion from UGX 828.8 billion in 2024. This comes despite global and regional economic pressures, with the bank crediting its four-year transformation strategy for the strong performance. The Group also delivered its highest-ever quarterly profit before tax of UGX 641.2 billion, well above the four-year quarterly average of UGX 414.4 billion.

Transformation and Strategic Direction

Since 2021, Equity has overhauled its governance, leadership, technology, and culture to align with its Africa Recovery and Resilience Plan (ARRP). The Group’s 2030 goal is to be present in 15 countries and serve 100 million customers, focusing on private sector-led development financing.

Key Half-Year Highlights

- Net interest income rose 9% as interest expenses fell 18%

- Loan loss provisions dropped 34%, helping cut total costs by 2%

- Loan book grew 4% to UGX 23.1 trillion, deposits rose 2% to UGX 36.96 trillion, and total assets increased 3% to UGX 50.4 trillion

- Strong capital and liquidity ratios give the Group room for further lending

- Regional Subsidiary Performance

* Kenya: Profit after tax up 40% to UGX 546 billion.

* DRC: Profit up 22% to UGX 254.8 billion.

* Uganda: Profit rose 40% to UGX 53.2 billion, deposits up to UGX 2.71 trillion, and investment securities reached UGX 1.03 trillion.

* Rwanda: Total assets up 21% to UGX 3.64 trillion, deposits at UGX 2.65 trillion, and loan book at UGX 1.57 trillion.

* Tanzania: Profit surged 75% to UGX 30.8 billion.

Regional operations now contribute 49% of deposits, 50% of the loan book, and 43% of profit after tax.

Insurance Business Growth

Equity now operates life, general, and health insurance arms. Life insurance gross premiums grew to UGX 106.4 billion, while general insurance collected UGX 38.08 billion in just six months. Total insurance group assets reached UGX 881.44 billion, with profits up 26%.

Technology and Non-Banking Growth

Over 98% of transactions now occur outside branches, with 87% via digital channels. Non-banking arms (technology and insurance) now contribute 4% of revenue and 3.8% of Group profit before tax.

Social Impact

Through the Equity Group Foundation, UGX 10.17 trillion has been disbursed to over 350,000 MSMEs, 2.49 million women and youth trained in financial literacy, and 5.9 million people supported via cash transfers worth UGX 4.75 trillion. Other initiatives include planting 36.4 million trees, distributing over 520,000 clean energy products, and providing 3.98 million medical visits through the Equity Afia network of 139 clinics.

Awards

In 2025, Equity was named Best Regional Bank in East Africa and maintained its title as Kenya’s most valuable brand. These accolades reflect not just financial success, but also the Group’s growing influence and positive impact across the region.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

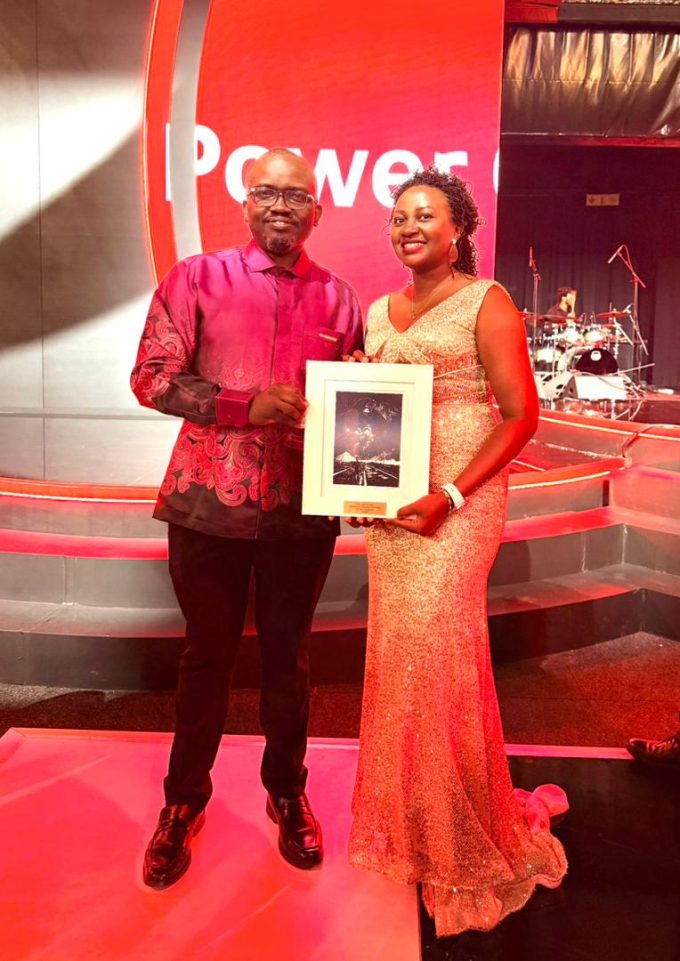

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...