Bank of Uganda Reports Sustained Inflation Stability in December 2025

The Bank of Uganda’s December 2025 Consumer Price Index (CPI) report indicates that inflation remained stable, reinforcing confidence in the country’s macroeconomic management as the year came to a close. The data shows that price pressures across key consumer categories were contained, supported by improved supply conditions and stable demand.

According to the Bank of Uganda, food crop inflation moderated during the month, largely due to increased market supply following seasonal harvests. Improved availability of staple foods helped limit sharp price increases, easing cost pressures on households and contributing significantly to the stability of headline inflation.

Non-food inflation also remained steady, reflecting limited movement in prices for housing, utilities, transport, education, and other essential services. Fuel and energy prices showed no major volatility, enabling businesses to manage operational costs more effectively. This stability is particularly important for sectors dependent on transport and energy inputs.

Core inflation, which excludes volatile food crops and energy prices, remained subdued in December. This suggests that underlying demand pressures in the economy are balanced and that inflation is not being driven by excess consumption or structural cost increases. The Bank of Uganda notes that this trend reflects the effectiveness of its monetary policy stance in anchoring inflation expectations.

From a business and investment perspective, the CPI outcomes point to a predictable operating environment. Stable inflation supports planning, pricing decisions, and investment confidence, while protecting household purchasing power. For policymakers, the data underscores the impact of coordinated fiscal and monetary interventions aimed at maintaining price stability.

As Uganda enters the new year, the Bank of Uganda has reiterated its commitment to closely monitor inflation developments and maintain policies that support sustainable economic growth while preserving price stability.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

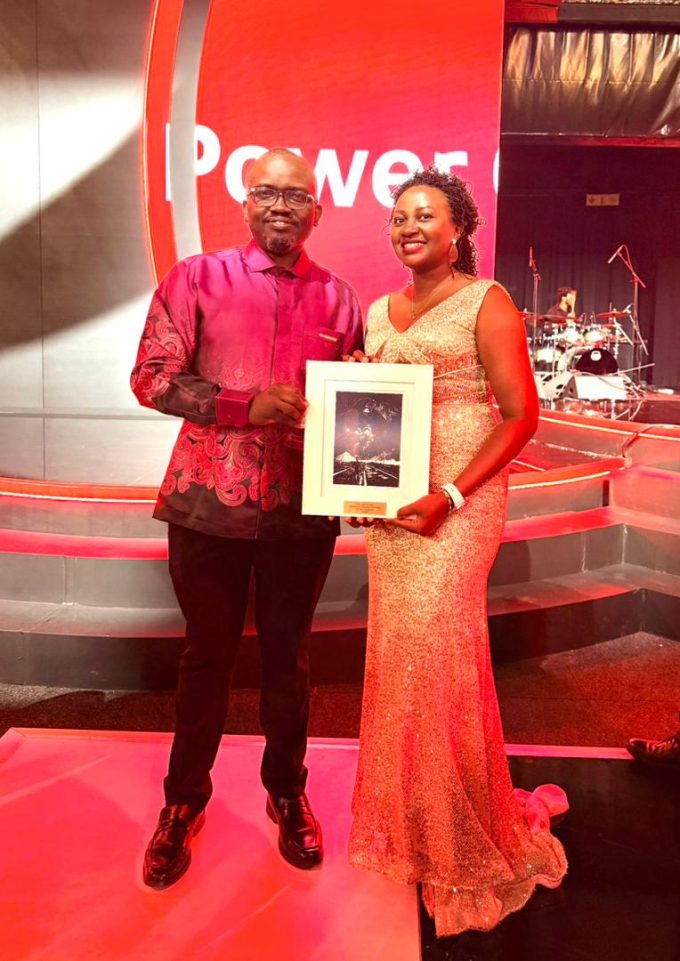

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...