Finance Trust Bank Credit Institution Approved by BoU

Finance Trust Bank credit institution approval marks a major regulatory step. The Bank of Uganda has authorized the bank to change from a Tier I commercial bank to a Tier II credit institution, effective April 1, 2026. The move aligns the bank’s operations with its core customers and long-term strategy.

Finance Trust Bank Credit Institution Status Confirmed by BoU

The Bank of Uganda confirmed that Finance Trust Bank meets Tier II capital requirements and remains well-capitalized. The board’s strategic review concluded that operating as a credit institution better fits the bank’s business model and customer focus.

To ensure a smooth transition, BoU has allowed three months—from January 1 to March 31, 2026—for the bank to phase out commercial-bank-only products. This phased approach protects customers and maintains financial stability.

Regulatory Changes Driving Finance Trust Bank Credit Institution Transition

Finance Trust Bank’s move comes after broader reforms in 2022. The Ministry of Finance and BoU raised the minimum capital requirement for commercial banks from UGX 25 billion to UGX 150 billion. These rules ensure banks have stronger capital buffers against economic shocks.

Since the reforms, several commercial banks have opted to scale down. Finance Trust Bank is the fourth to transition. ABC Capital Bank, Guaranty Trust Bank (Uganda), and Opportunity Bank moved to Tier II in 2024.

What Finance Trust Bank Credit Institution Means for Customers

During the transition, Finance Trust Bank has assured customers that services will remain uninterrupted. Branch operations and regulatory compliance will continue without disruption.

As a Tier II credit institution, the bank will focus on deposit-taking and lending services. Products requiring a Tier I licence, like foreign exchange trading, will be phased out. This change ensures the bank aligns services with Tier II regulations while protecting customers.

Implications for Uganda’s Banking Sector

The Finance Trust Bank credit institution transition highlights ongoing changes in Uganda’s banking landscape. Capital adequacy, regulatory compliance, and risk management remain central to financial stability and growth. This step reinforces the sector’s resilience and prudent governance.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

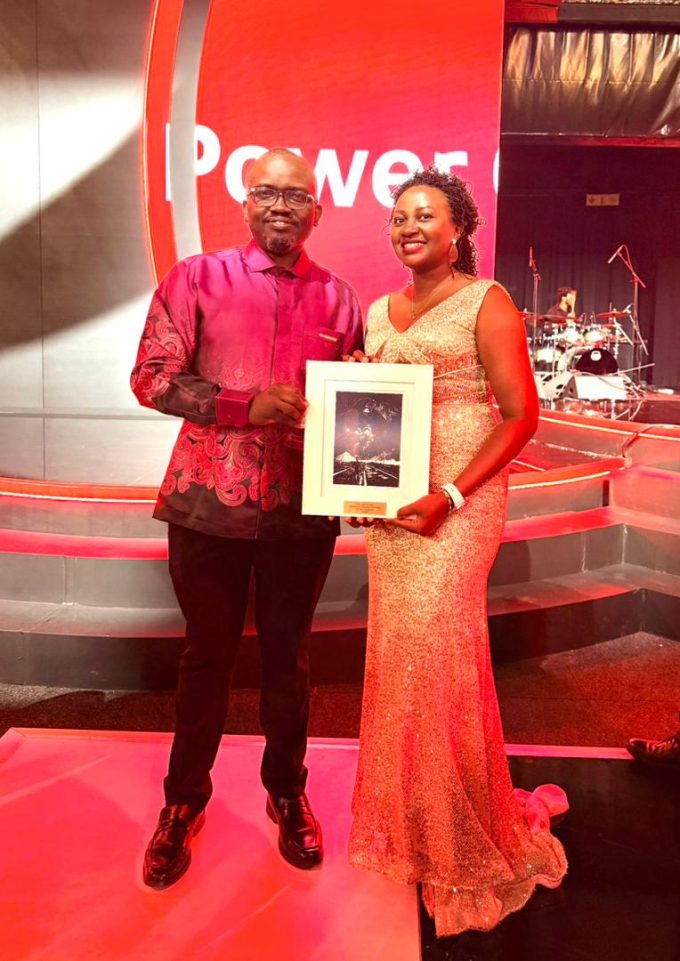

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...