MTN Uganda Share Price Rise Delivers Big Profits for Local Investors

MTN Uganda’s share price has been climbing steadily over the past few months, moving from 270 shillings to 312 shillings by November 25, 2025. This rise has turned into a major gain for local shareholders, especially the National Social Security Fund (NSSF) and businessman Charles Mbire.

For NSSF, which holds about 10.7 percent of MTN Uganda, the increase of 42 shillings per share translated into more than 110 billion shillings in added value. At the current price, NSSF’s entire stake is now worth over 820 billion shillings, making it one of the fund’s strongest performing investments this year.

Charles Mbire, the company’s chairman and another major shareholder, also benefitted greatly. His 4 percent stake recorded an increase of about 37 billion shillings in value, pushing the total worth of his shares to roughly 279 billion shillings.

The rise in MTN’s share price is linked to the telecom’s solid business performance, especially its fast-growing digital and mobile money services, as well as the company’s consistent dividend payments, which attract many investors. MTN has also continued expanding its customer base, giving shareholders confidence in the company’s future earnings.

For Uganda’s stock market, this rally is another sign that strong-performing companies can deliver real financial rewards for ordinary and institutional investors. And for shareholders like NSSF and Mbire, it’s a clear reminder of the long-term value that comes with holding a stake in one of the country’s biggest telecom companies.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

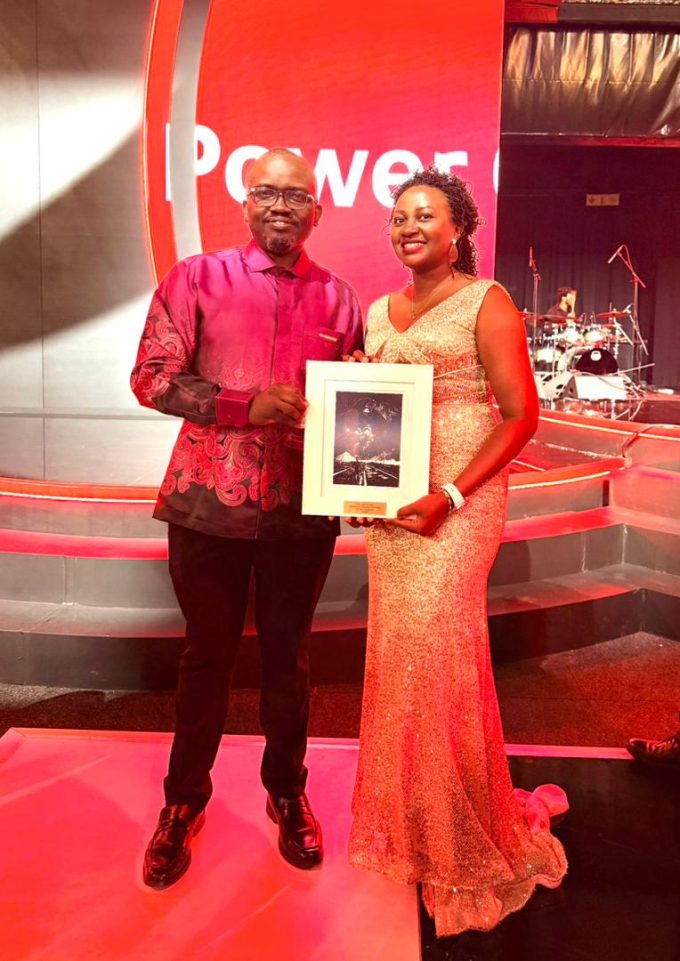

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...