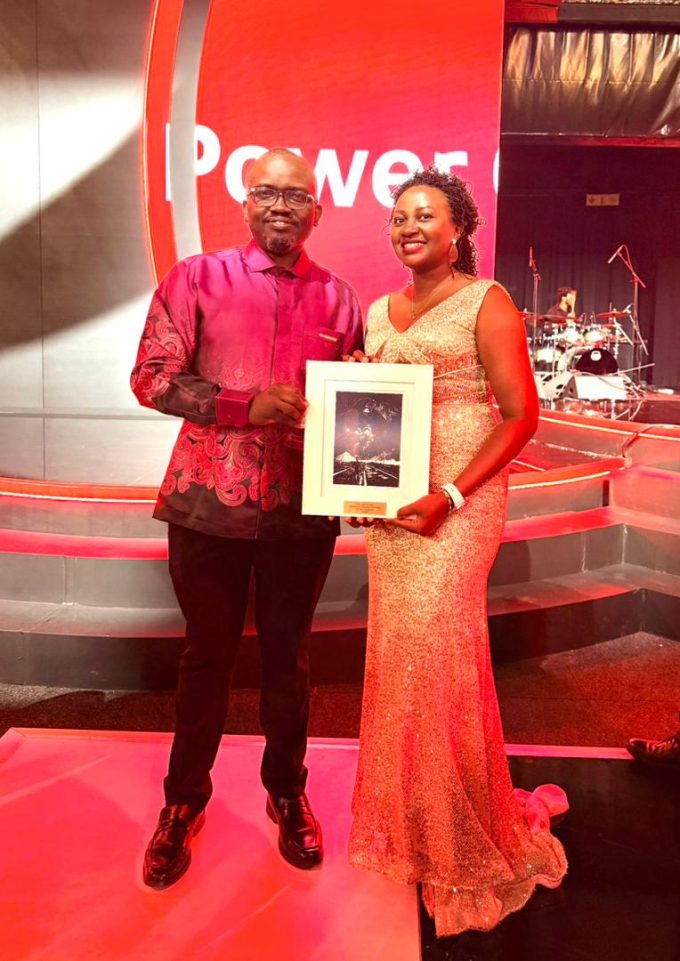

Rachel Rwakatungu — From Entry-Level to Credit Leadership: Navigating Uganda’s Banking Sector with Vision and Resolve

In a sector where risk assessment, discipline, and foresight determine not just the stability of banks but the financial lives of thousands, Rachel Rwakatungu stands out as a leader shaping credit strategy and corporate governance in Uganda’s banking industry. Her rise to Credit Director at Absa Bank Uganda is a testament to resilience, expertise, and an unwavering commitment to professional growth.

A Humble Beginning — Building from the Ground Up

Rachel began her professional journey far from boardrooms. Her first job, shortly after university, was as an administrative/accounts assistant at a startup pharmaceutical company. That modest start taught her key lessons in discipline, service, and attention to detail qualities that would prove invaluable in her later banking career.

Within a year, she transitioned to the banking sector, embarking on a career that would span multiple institutions and countries, each step marked by growth, learning, and increasing responsibility.

A Progressive Career Across Leading Banks

Over the years, Rachel accumulated diverse experience across some of the most prominent banks in Uganda and beyond:

At Standard Chartered Bank Uganda, she worked in several capacities, including Credit Analyst, Relationship Manager in Corporate Banking, and Head of the Client Service Group roles that allowed her to understand credit risk, corporate relationships, and client service from the ground up.

She also gained exposure abroad, working in Standard Chartered Bank Tanzania and Stanbic Bank South Africa broadening her perspective on banking practices, risk environments, and regulatory frameworks.

Later, she joined Stanbic Bank Uganda as Senior Credit Manager. There, she led credit approval processes, risk assessment frameworks, and managed end-to-end credit decision cycles gaining a reputation for thoroughness, fairness, and a strong appetite for balancing opportunity with risk.

This accumulation of experience, across banks and geographies, laid the foundation for what would become a defining moment in her career.

The Summit: Becoming Credit Director at Absa Bank Uganda

In May 2023, Absa Bank Uganda appointed Rachel as its new Credit Director, a role that would place her at the core of the bank’s credit risk management and credit approval framework. Her remit: to safeguard the institution’s credit portfolio while enabling growth and financial inclusion through prudent lending.

In taking up that mantle, Rachel described herself as “excited to be joining Absa Bank Uganda at such a crucial time in its growth journey,” committing to work closely with her team to deliver tailored and innovative credit solutions, always balanced with prudent risk oversight.

Philosophy & Approach — Risk Balanced with Opportunity, Discipline Anchored in Empathy

What distinguishes Rachel is not just her technical skills or her years of experience. It’s her commitment to a growth mindset, even as she demands rigour, fairness, and discipline in her work. In a 2023 interview she reflected: “Credit remains pivotal to a bank’s success in a very dynamic world, decisions must always be based on well-thought recommendations.”

She credits her progression not just to competence, but to continuous learning: combining technical acumen with soft skills, mentorship, coaching, and a readiness to adapt. Her journey underscores that success in banking especially in credit is about balancing numbers with humanity: understanding clients, markets, regulatory frameworks, and the socio-economic landscape.

Impact & Broader Significance — Beyond Credit Approvals

As Credit Director, Rachel’s influence extends far beyond internal approvals and risk policies. She plays a strategic role in shaping credit culture in one of Uganda’s leading banks, a position that affects small businesses, corporate clients, and individuals seeking financing.

Her leadership supports Uganda’s economic growth by ensuring that credit, the lifeblood of business expansion remains accessible yet sustainable, disciplined yet inclusive. The ripple effect: enabling enterprises to grow, supporting jobs creation, and contributing to national development resilience.

Moreover, her story sends a powerful message to young professionals especially women that with commitment, learning, and integrity, it’s possible to rise through the ranks in the banking industry, even in roles that require both technical mastery and leadership.

“The largest industry impact I’m driving now in Credit is through my role as the Chairperson of the Uganda Bankers Association Credit Committee. Under this we are tasked to drive the industry as we grow and maintain the assets – though strategic, policy and regulatory engagements – in order to maintain the integrity of the banking sector.” Rachel

Why Rachel Rwakatungu Moves Nations

Rachel ’s journey from an accounts assistant to Credit Director embodies the essence of #WomenWhoMoveNations. She leads with discipline, builds with vision, and inspires through her unwavering commitment to excellence, integrity, and impact.

In a sector often defined by complexity and risk, Rachel stands out for bringing clarity, fairness, and a growth mindset. Her leadership helps shape Uganda’s financial future one credit decision at a time.

Rachel shows that success isn’t just about titles it’s about consistent performance, thoughtful leadership, and the courage to grow beyond comfort zones.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...