Uganda Bankers’ Association Unveils New Digital Financial Services Leadership Team

The Uganda Bankers’ Association (UBA) has announced the new leadership team of its Digital Financial Services Committee for the 2025/2026 term — a dynamic group of professionals dedicated to fueling digital transformation, financial inclusion, and innovation in Uganda’s banking industry.

According to UBA, the committee plays a pivotal role in advancing collaboration among financial institutions, fintechs, and regulators to strengthen the country’s digital finance ecosystem.

“This new leadership comes at a time when Uganda’s financial sector is rapidly evolving through technology. The team’s expertise and vision will be instrumental in driving innovation and deepening financial inclusion,” said a UBA representative.

Meet the New Leaders

Brenda Mpoora, Head of Fintech Business at PostBank Uganda, has been elected Chairperson of the committee. With vast experience spanning banking, fintech, and telecommunications, Brenda brings a strong passion for financial empowerment and advancing digital literacy — particularly within underserved communities.

“I’m honored to take on this role at such a transformative time for Uganda’s banking industry,” Brenda said. “Our focus will be on collaboration, innovation, and creating impactful digital solutions that make financial services more accessible to all.”

Emmanuel Kikoni Jr., PMP, MBA, the Head of Cash Management at Ecobank Uganda, has been elected Vice Chairperson. With over 18 years of experience in retail and corporate banking, Emmanuel is known for driving strategic digital transformation and pioneering innovative cash management solutions.

“Digital transformation is not just about technology — it’s about creating value for customers,” Emmanuel noted. “Our mission is to build stronger, smarter, and more inclusive financial systems that empower individuals and businesses alike.”

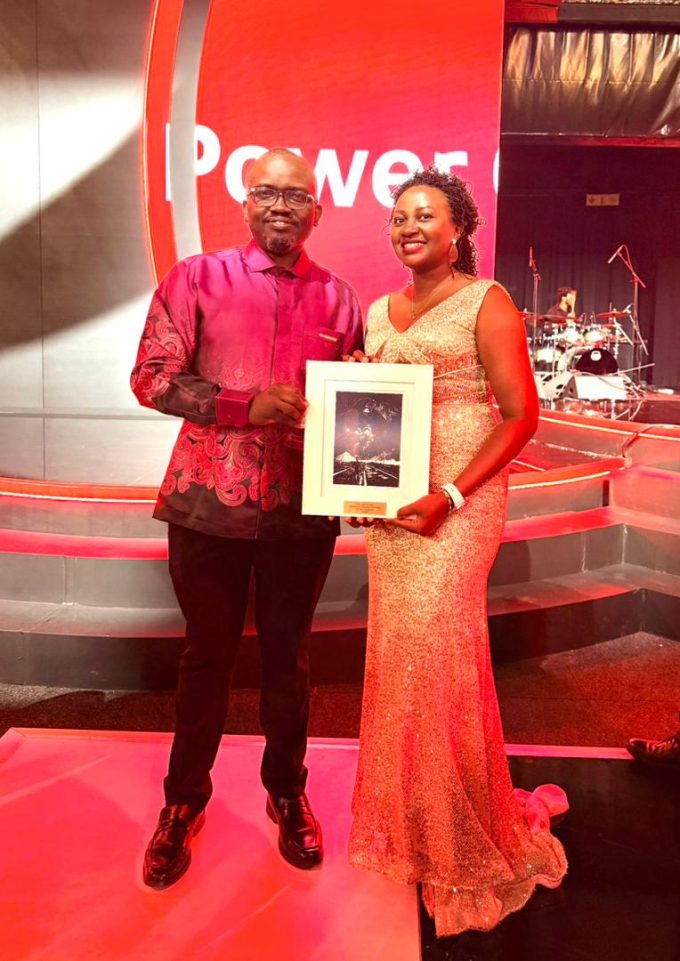

Diana Atuhaire, Manager of Platform & Product, Digital & eCommerce, Personal & Private Banking at Stanbic Bank Uganda, joins the leadership team as Honorary Secretary. Diana is widely recognized for her expertise in digital banking and product innovation, with a strong focus on enhancing customer experience.

“I’m excited to contribute to an agenda that prioritizes inclusion, innovation, and customer-centered design,” Diana said. “Our goal is to ensure digital financial services continue to grow in ways that truly meet the needs of Ugandans.”

Driving the Future of Digital Banking

The UBA says this new leadership team embodies the collaborative spirit and forward-thinking approach that have defined Uganda’s digital finance journey in recent years. Through shared vision and coordinated efforts, the committee will continue to strengthen the country’s digital financial ecosystem.

“The future of banking in Uganda is digital, inclusive, and customer-driven — and this team is well positioned to lead that transformation,” the Association added.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...