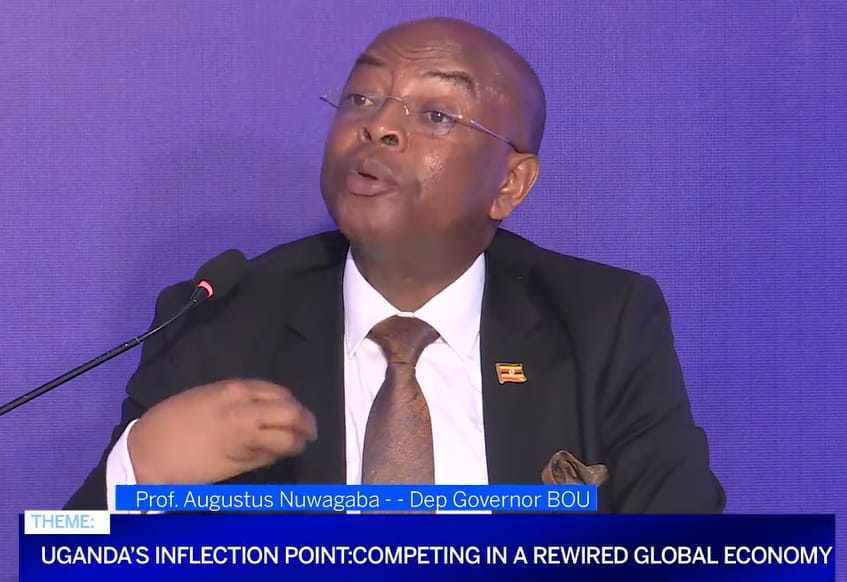

Uganda’s economy at inflection point — this was the key message from Bank of Uganda Deputy Governor Prof. Augustus Nuwagaba. He said the country remains stable and resilient, positioning it for stronger long-term growth.

Prof. Nuwagaba spoke at the Stanbic Economic Forum 2026 under the theme “Uganda’s Inflection Point: Competing in a Reconfigured Global Economy.” His remarks focused on monetary stability, structural transformation, and emerging growth drivers.

Prof. Nuwagaba reiterated the central bank’s core mandate: to promote price stability and maintain a sound financial system.

He explained that this mandate directly supports Uganda’s socio-economic transformation agenda. In particular, monetary policy aligns with investments under National Development Plan IV.

Therefore, the central bank continues to design policies that support structural transformation and inclusive growth.

Strong Growth Amid Stable Prices

According to Prof. Nuwagaba, Uganda’s economic fundamentals remain solid.

GDP growth has averaged 6.4% over the past three years. At the same time, inflation has remained contained.

Headline inflation averaged 3.5%, while core inflation stood at 3.8% in the 12 months to January 2026. Notably, both figures remain below the Bank of Uganda’s 5% medium-term target.

He said this performance reflects the effectiveness of the central bank’s monetary policy tools.

Looking ahead, Prof. Nuwagaba identified oil and gas production as a major future growth driver once commercial production begins.

Additionally, government investment continues under the ATMS framework:

- Agro-industrialization

- Tourism development

- Mineral-based industrial development

- Science, technology and innovation

He noted that these sectors will strengthen Uganda’s productive capacity and improve export competitiveness.

Stable Exchange Rate Supported by Exports

Prof. Nuwagaba also highlighted exchange rate stability.

Over the past 12 months to January 2026, the Uganda shilling averaged UGX 3,592 per US dollar.

He attributed this stability to strong export earnings. Coffee, cocoa, and gold exports played a major role. Moreover, workers’ remittances and offshore investor inflows supported foreign exchange reserves.

As a result, the shilling has remained relatively stable despite global volatility.

Modernising Payments and Expanding Financial Inclusion

The Bank of Uganda is also strengthening payment systems to improve efficiency.

Key areas of support include:

- Bulk payments through the Real Time Gross Settlement System (RTGS)

- Electronic Funds Transfers (EFTs)

- Mobile money platforms

- Expanding fintech solutions

These innovations reduce transaction costs and improve ease of doing business.

Furthermore, the central bank continues to prioritise financial inclusion. Expanding access to credit, he said, will widen economic participation and accelerate growth.

Risks and Caution

Despite the strong outlook, Prof. Nuwagaba warned that risks remain.

He noted that the central bank continues to monitor global and domestic challenges. Where necessary, it will deploy appropriate policy responses to safeguard macroeconomic stability.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

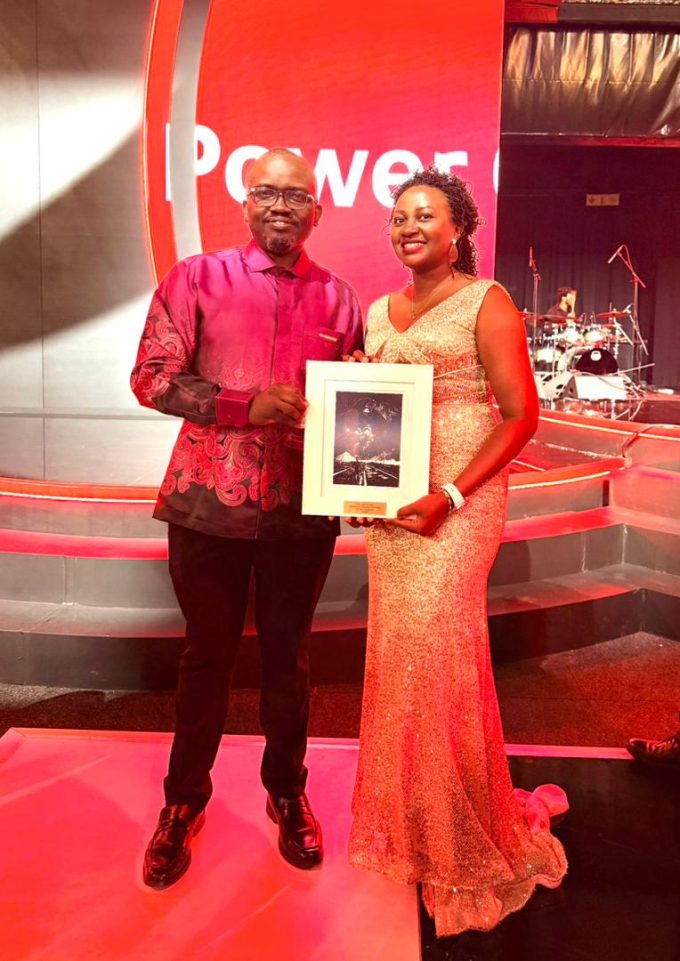

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...

Uganda IFAD Agricultural Financing and Oil Palm Expansion Talks in Rome

Uganda IFAD agricultural financing and oil palm expansion discussions took center stage...