Vision Group Financial Challenges: Losses, Cash Flow, and Governance

Revenue Pressures Highlight Vision Group Financial Challenges

Vision Group financial challenges have intensified due to declining print circulation, weakened advertising revenues, and high operating costs. Despite efforts to diversify revenue streams beyond print media, these initiatives have not yet generated sufficient returns to offset losses from core operations.

The company’s negative cash flow shows that revenues collected during the year were insufficient to cover operating expenses. This situation undermines liquidity and raises questions about Vision Group’s ability to meet short-term obligations without restructuring or additional financing.

Leadership and Governance Amid Financial Challenges

Under Managing Director Don Wanyama, Vision Group has implemented several turnaround strategies to stabilize finances and restore profitability. However, the latest audit findings indicate that these efforts have so far failed to reverse the company’s downward financial trajectory.

The Auditor General’s report emphasizes the need for stronger financial controls, improved cash management, and a clear, measurable turnaround strategy. These measures are crucial to address recurring losses, compliance risks, and the company’s broader financial challenges.

Outlook for Vision Group Financial Challenges

The combination of multi-billion-shilling losses, negative operating cash flows, loan covenant breaches, and additional costs from penalties leaves Vision Group in a vulnerable position. Without decisive corrective action, the company risks further erosion of shareholder value and increased reliance on lenders and state support.

Analysts suggest that addressing Vision Group financial challenges requires immediate cost reduction, revenue diversification, and stricter governance oversight. Additionally, transparent reporting to Parliament, shareholders, and regulators will help stabilize the company as it navigates a rapidly changing media and advertising landscape.

Strategic Steps to Overcome Financial Challenges

To regain financial stability, Vision Group must strengthen internal controls, implement better cash management practices, and communicate clear turnaround strategies. Transparent progress tracking and timely stakeholder updates will also support long-term sustainability and rebuild trust in the company.

Latest News

Stanbic Bank Supports Life-saving Maternal care

Stanbic Bank maternal healthcare support Uganda is making a meaningful impact through...

Uganda’s Economy at Inflection Point

Uganda’s economy at inflection point — this was the key message from...

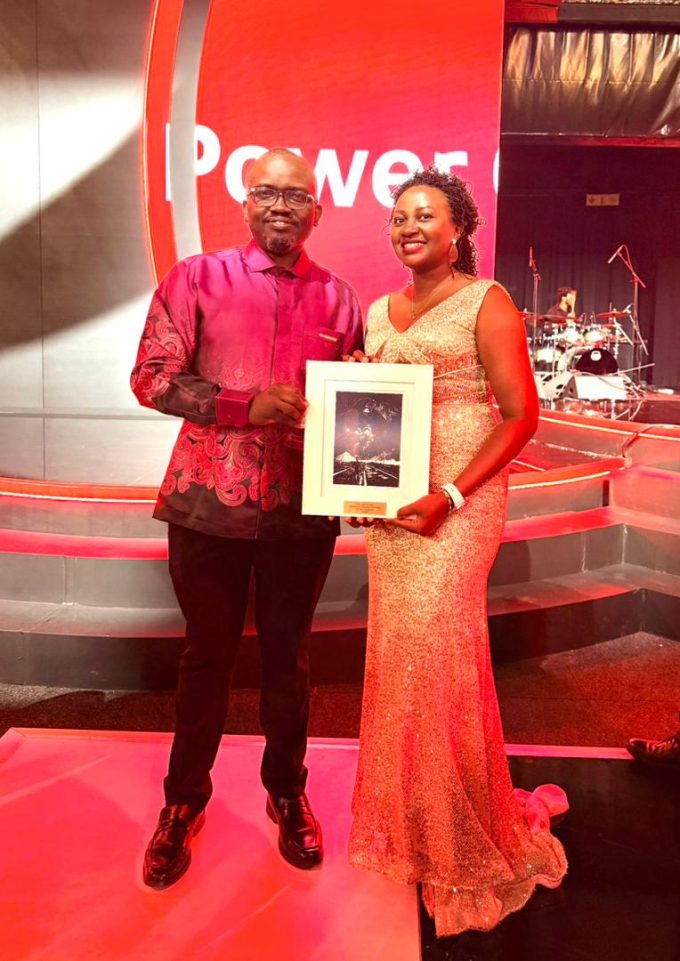

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Stanbic Names Oigara CEO as Mweheire Steps Down

Stanbic names Oigara CEO in a significant leadership transition that signals the...