Banking Leaders Reflect on a Strong Year and the Path Ahead to 2026

The Uganda Bankers’ Association (UBA) recently held an engaging informal dinner with the Governor of the Bank of Uganda, Dr. Michael Atingi‑Ego, alongside CEOs from across the banking sector. The gathering provided an opportunity to reflect on a strong year for Uganda’s financial sector and to discuss strategies for building a more innovative and resilient future.

“The banks that will thrive in the decade ahead will be those that treat capital not as a constraint but as strategic capacity,” Dr. Atingi‑Ego said, highlighting the importance of strategic planning in a rapidly evolving financial landscape.

The Governor stressed the need for banks to integrate sustainability and financial inclusion into their operations. From supporting climate‑smart agriculture to expanding financing for small and medium enterprises, he emphasized that the future of banking lies in adaptation and impact.

“By the 2027 reporting cycle, we expect every bank to provide credible disclosures on how climate considerations influence lending and investment decisions,” he added.

Dr. Atingi‑Ego also aligned his remarks with Uganda’s Tenfold Growth Strategy (ATMS), encouraging banks to adopt longer‑tenor financing, sector specialization, blended finance, and digital innovation as they position themselves for future growth.

He shared key statistics demonstrating the sector’s strong performance: “Between December 2024 and September 2025, total banking assets expanded by UGX 4.93 trillion, loans and advances grew by UGX 1.51 trillion, deposits rose by UGX 4.56 trillion, and net profits increased by 46.23%. These are not just statistics but indicators of public trust.”

As the banking sector looks toward 2026, UBA reaffirmed its commitment to leading the transformation of Uganda’s financial landscape by deepening financial inclusion, embedding sustainability, and driving innovation.

Latest News

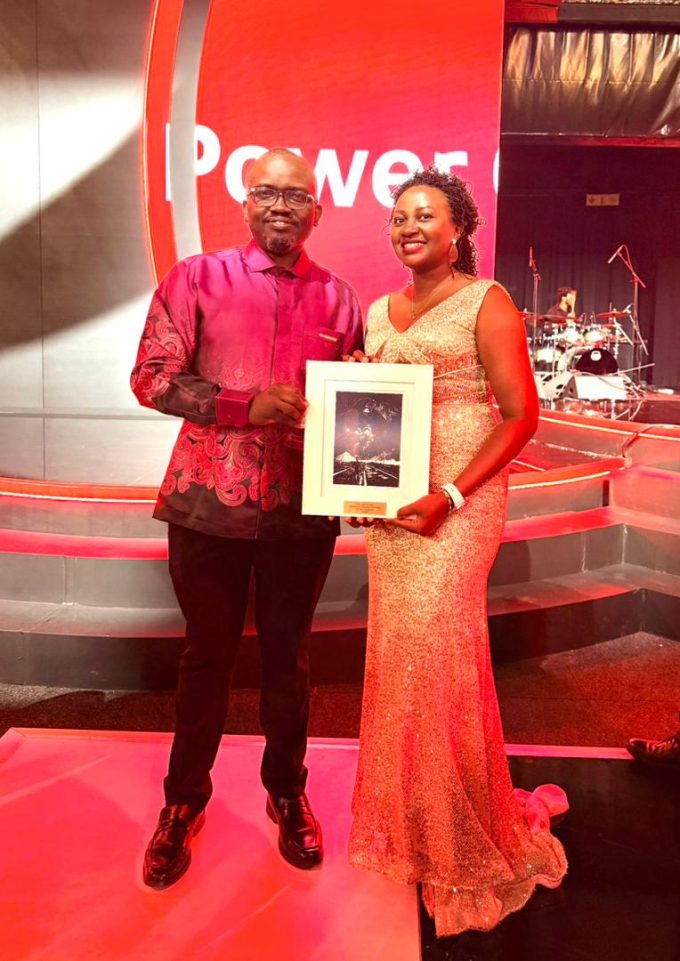

Pamela Turyatunga’s Jasiri Win: What It Means for Absa Bank Uganda and the Future of Sustainability Leadership

From Recognition to Reinforcement: Pamela Turyatunga’s Jasiri Award Signals Absa Uganda’s Sustainability...

Uganda IFAD Agricultural Financing and Oil Palm Expansion Talks in Rome

Uganda IFAD agricultural financing and oil palm expansion discussions took center stage...

Uganda Financial Markets Strengthened at Absa Africa Forum

Uganda’s financial markets were in the spotlight as regulators, policymakers, and private...

EBO SACCO, Equity Bank Join Hands to Deepen Financial Inclusion

EBO SACCO has entered into a partnership with Equity Bank aimed at...